In 2024, the Enel Group (the “Group”) posted a solid performance, reflecting its ability to reach objectives in line with the Strategic Plan presented a year ago.

In the 2025-2027 Plan period, the Group confirms its strategic pillars:

- Profitability, flexibility and resiliency to generate value through selective capital allocation that optimizes the risk/return profile while maintaining a flexible approach.

- Efficiency and effectiveness with a continued optimization of processes, activities and portfolio of offerings, strengthening cash generation and developing innovative solutions to enhance the value of existing assets.

- Financial and environmental sustainability to maintain a solid structure, ensuring the flexibility required for growth and addressing the challenges posed by climate change.

In the 2025-2027 Plan, Group total gross capex amounts to approximately 43 billion euros, around 7 billion euros more than the previous Plan. Specifically, the Group expects to allocate:

- About 26 billion euros in Grids (+40% compared to the previous Plan), of which around 78% in Italy and Spain, countries characterized by regulatory frameworks that can support investments, and about 22% in Latin America.

- Approximately 12 billion euros in Renewables, adding around 12 GW of capacity, with an improved technological mix that foresees over 70% of onshore wind and dispatchable technologies (hydro and batteries), up to an overall capacity of about 76 GW and an increase of over 15% in production in 2027.

- Around 2.7 billion euros in Customers, of which approximately 85% in countries where the Group has an integrated presence, offering a portfolio of bundled solutions with energy, products and services

The Group plans to allocate investments proportionally across its main geographies, based on their contributions to EBITDA, with around 75% in Europe as well as about 25% in Latin and North America.

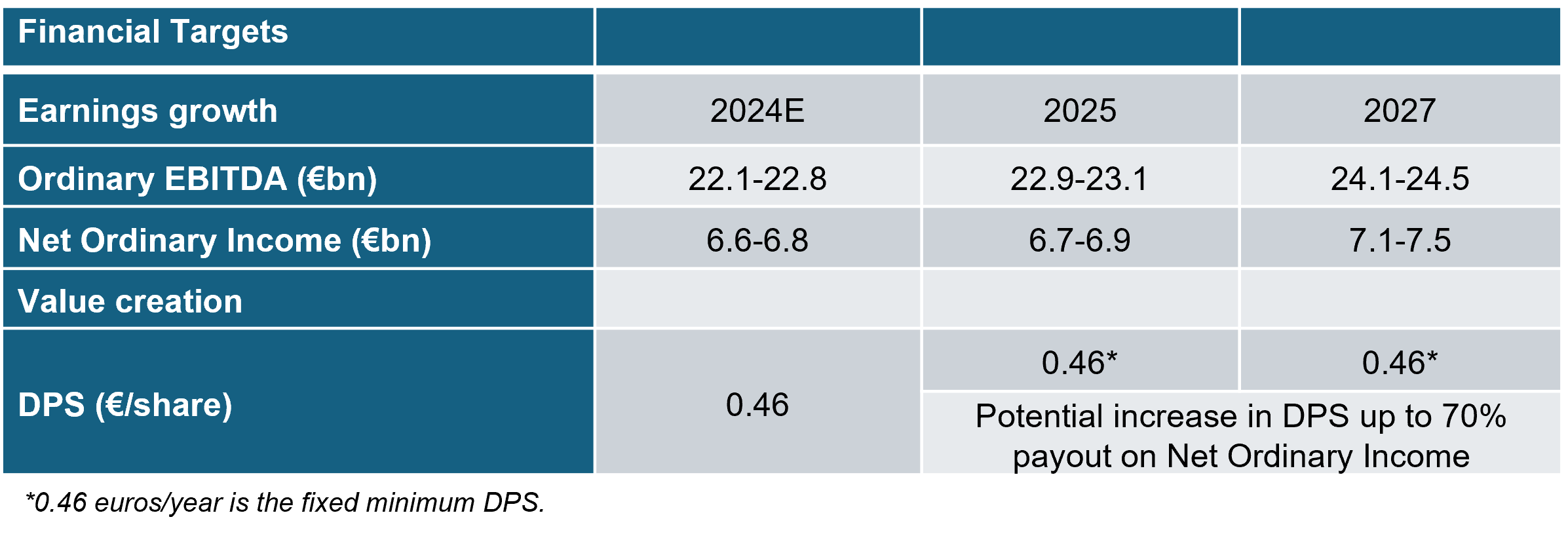

In 2027, Group Ordinary EBITDA is expected to grow to between 24.1 and 24.5 billion euros and Group Net Ordinary Income is expected to increase to between 7.1 and 7.5 billion euros.

The visibility on Group 2024 financial results allows for the proposal at Enel’s next Shareholders’ Meeting of an overall dividend payout of 0.46 euros per share, above the fixed minimum dividend per share (“DPS”) of 0.43 euros set in the previous Plan.

Throughout the 2025-2027 period, the implementation of the strategic actions is expected to result in visible and highly predictable returns; on this basis, the dividend policy was revised upwards with a new fixed minimum annual DPS of 0.46 euros and a potential further upside corresponding to up to a 70% payout on Group Net Ordinary Income.

“The managerial actions carried out in the past year allowed us to achieve all the targets we announced to the markets and to strengthen the Group’s financial solidity. We can therefore begin a new chapter of growth that will create further value for shareholders and all our stakeholders,” said Flavio Cattaneo, CEO of Enel. “Between 2025 and 2027, we will focus on core activities and a flexible capital allocation, increasing investments mainly on regulated assets with predictable returns that will also support the acceleration of the energy transition. Moreover, we will continue to enhance efficiency and profitability, including through new business opportunities. This strategy enables us to revise the dividend policy upwards over the Plan period with a fixed minimum dividend of 0.46 euros per share increasing from 0.43 euros set in the previous Plan and with a potential further upside of up to a 70% payout on Net Ordinary Income.”

*****

Today, Enel is presenting the Group’s 2025-2027 Strategic Plan to financial markets and the media in Rome.

The Enel Group in 2024

Over the course of 2024, the Group has posted a solid performance, reflecting the ability to deliver on objectives in line with the Strategic Plan presented a year ago. Specifically:

- The disposal plan has been successfully completed[1];

- The Group has refocused on its core businesses and investments with higher profitability, improving productivity and capital structure;

- Debt has been reduced in line with the targets set, well positioning the Group for long-term, sustainable and more profitable growth.

The Group is now ready to start a new chapter of sustainable growth.

The energy context

In the coming years, electricity will continue to play a leading role in the energy transition, with an increase in consumption driven by electrification. Against this background, renewables are expected to grow even further and power systems to continue to require baseload and flexibility technologies with the aim to meet demand at any time of day as well as minimize price volatility.

Distribution networks will continue to be the enablers of the energy transition, requiring higher investments to host the growing renewable capacity as well as guaranteeing increased resilience to extreme weather events that are even more frequent, severe and that have become the new normal due to the effects of climate change.

In this context, new power market designs and adequate regulatory frameworks will be necessary to remunerate investments and sustain growth both in renewables and grids.

The 2025-2027 strategic plan

In its 2025-2027 Strategic Plan, the Group confirms its focus on three pillars:

- Profitability, flexibility and resiliency to generate value through selective capital allocation that optimizes the risk/return profile while maintaining a flexible approach;

- Efficiency and effectiveness with a continued optimization of processes, activities and portfolio of offerings, strengthening cash generation and developing innovative solutions to enhance the value of existing assets;

- Financial and environmental sustainability to maintain a solid structure, ensuring the flexibility required for growth and addressing the challenges posed by climate change.

1. PROFITABILITY, FLEXIBILITY AND RESILIENCY

Between 2025 and 2027, the Group has planned a total gross capex of approximately 43 billion euros, an increase of around 7 billion euros on the previous Strategic Plan, allocated to geographies in proportion to their EBITDA contribution. The main areas for investment will be:

- Europe, with about 75% of the overall gross capex;

- Latin and North America, with around 25% of the overall gross capex.

Grids

In the 2025-2027 Plan, gross capex in Grids is expected to amount to approximately 26 billion euros, an increase of 40% compared with the previous Plan. Out of the total capex in Grids, around 78% is expected to be allocated in Italy and Spain, countries characterized by regulatory frameworks that can support investments, while around 22% will be addressed to Latin America. Specifically, the Group plans to invest:

- In Italy, over 16 billion euros;

- In Iberia, approximately 4 billion euros;

- In Latin America, about 6 billion euros.

The increase in investments in Grids is expected to drive the Group’s Regulated Asset Base (RAB)[2] to approximately 52 billion euros in 2027 from around 43 billion euros estimated in 2024. On the back of these investments, the Group’s power grids are expected to be more resilient, digitalized and efficient. Furthermore, the Group will maintain its commitment to advocacy activities in favor of regulatory frameworks that support the central role grids play in the energy transition.

As a result of investments allocated to Grids, this business segment is expected to account for about 40% of Group Ordinary EBITDA in 2027.

Integrated Business

In the 2025-2027 Plan, gross capex in the Integrated Business is expected to amount to more than 16 billion euros.

In Renewables, the Group plans to invest approximately 12 billion euros with flexible capital allocation and a selective approach aimed at maximizing returns while minimizing risks, also seizing on brownfield asset opportunities with the aim to further enhance profitability. The Group plans to add around 12 GW of capacity, with an improved technological mix that foresees more than 70% from onshore wind and dispatchable technologies (hydro and batteries), reaching a total installed renewable capacity of about 76 GW in 2027. Group total renewable production is expected to increase by over 15% in the Plan period across all geographies, mainly in Europe and the United States, which will account for about 55% of total Group renewable production in 2027.

From a geographical standpoint, gross capex in Renewables will be allocated as following:

- Around 65% in Europe (of which approximately 34% in Italy and about 31% in Iberia), where new regulatory frameworks are deemed to support decarbonization plans;

- Approximately 35% in Latin and North America.

In the 2025-2027 Plan, the gross capex in the Customers’ segment is expected to amount to approximately 2.7 billion euros, around 85% of which in countries where the Group has an integrated presence, offering a portfolio of bundled solutions with energy, products and services. The Group expects to increase its free-market power customer base in Italy and Spain to over 19 million in 2027.

Group Ordinary EBITDA

In the Plan period, Group cumulated Ordinary EBITDA is expected to exceed 70 billion euros, around 90% of which (about 64 billion euros) will result from regulated or contracted activities, reducing risks and enhancing visibility on future results. More specifically, the Group expects:

- approximately 27 billion euros addressed to grids;

- around 4 billion euros related to power generation covered by long-term regulatory schemes;

- approximately 23 billion euros referring to Power Purchase Agreements (PPAs), mainly in Latin America and North America;

- about 10 billion euros relating to end users with volumes sold at fixed prices.

2. EFFICIENCY AND EFFECTIVENESS

In 2027, the Group plans to achieve efficiencies of around 1.5 billion euros on the 2022 baseline, increasing the target by about 500 million euros compared to the previous Plan, by continuing process optimization and the insourcing of external activities.

Furthermore, efficiencies and value creation can be achieved also through innovation and new business models. Specifically, the Group is setting up a NewCo aimed at consolidating existing and new connection assets that are both proprietary and of third parties, handling operation and maintenance (O&M) as well as construction activities. Moreover, the Group is defining value propositions in the fast-growing Data Center sector, in relation to which optimized grid connection solutions and integrated renewable energy offers are expected. The associated potential economic benefits are not included in the 2025-2027 Plan.

3. FINANCIAL AND ENVIRONMENTAL SUSTAINABILITY

Financial equilibrium will continue to guide the Group’s strategy. Through the results registered and the completion of the disposal plan that was re-engineered last year, the Group achieved its deleverage objective, with a Net Financial Debt/EBITDA ratio expected at around 2.4x at the end of 2024, compared with 3.1x in 2022, a much lower level than that of its peers (with a sector average of around 3.1x). The financial solidity obtained provides the Group with the flexibility required to seize market opportunities, fund its growth ambitions and maximize shareholder remuneration. At the end of the Plan period, the Net Financial Debt/EBITDA ratio is expected to stand at around 2.5x, remaining well below the sector average. In addition, also thanks to the Group’s lower exposure to non-core geographies and the continued focus on sustainable finance, the overall cost of gross debt is expected to decrease to 3.9% in 2027.

In 2027, sustainable finance sources are expected to account for approximately 75% of total gross debt, with an increase of 5 percentage points compared with the target set in the previous Plan.

When it comes to environmental sustainability, the Group plans to continue reducing its direct and indirect greenhouse gas emissions, in line with the Paris Agreement and compliant with the 1.5°C pathway, as certified by the Science Based Targets initiative (“SBTi”). Specifically, the Group confirms its target to close all of its remaining coal plants by 2027, subject to the authorizations of competent authorities. For coal plant reconversion, the Group will evaluate the best available technologies, based on the needs indicated by the transmission grid operators. The Group confirms its ambition to reach zero emissions across all scopes by 2040. Furthermore, along this path, the Group aims to continue to preserve the social and economic context through its Just Transition plan.

Financial targets

Group Ordinary EBITDA is expected to grow to between 24.1 and 24.5 billion euros in 2027, with a Compound Average Growth Rate (“CAGR”) of around 7%[3] compared to 17.3 billion euros in 2022[4].

Group Net Ordinary Income is expected to increase to between 7.1 and 7.5 billion euros in 2027, with a CAGR of around 11%3 compared to 4.3 billion euros in 20224.

Shareholder remuneration

The visibility on Group 2024 financial results allows for the proposal at Enel’s next Shareholders’ Meeting of an overall dividend payout of 0.46 euros per share, above the fixed minimum dividend per share (“DPS”) of 0.43 euros set in the previous Plan. Throughout the 2025-2027 period, the implementation of the strategic actions is expected to result in visible and highly predictable returns; on this basis the dividend policy was revised upwards with a new fixed minimum annual DPS of 0.46 euros and a potential further upside corresponding to up to a 70% payout on Group Net Ordinary Income. Furthermore, compared to the previous dividend policy, the cash-flow neutrality gate was removed.

*****

Key performance indicators

This press release uses a number of “alternative performance measures” that are not envisaged by the international accounting standards adopted by the European Union - IFRS-EU, in line with the ESMA Guidelines on alternative performance indicators (ESMA Guidelines/2015/1415). In particular, management deems these indicators useful for the better evaluation and monitoring of the Group’s economic and financial performance. With regard to these indicators, on April 29th, 2021, CONSOB issued Warning Notice no. 5/21, making applicable the Guidelines issued on March 4th, 2021, by the European Securities and Markets Authority (ESMA) on disclosure requirements pursuant to EU Regulation 2017/1129 (the so-called “Prospectus Regulation”), which are applicable from May 5th, 2021 and replace the references to the CESR recommendations and those in Communication no. DEM/6064293 of July 28th, 2006 on net financial position; specifically, the Guidelines update the previous CESR Recommendations (ESMA/2013/319, in the revised version of March 20th, 2013).

These Guidelines are intended to promote the usefulness and transparency of alternative performance measures included in regulated information or prospectuses within the scope of application of Directive 2003/71/EC in order to improve their comparability, reliability and comprehensibility.

In line with the abovementioned communications, the criteria used for the construction of these indicators for the Enel Group are provided below:

- Ordinary EBITDA is defined as “EBITDA”[5] attributable to ordinary operations only, linked to the business models of Ownership, Partnership and Stewardship according to which the Group operates, integrated with the ordinary EBITDA attributable to discontinued operations, if present. It also excludes costs associated with corporate restructuring plans and “extraordinary solidarity contributions” established by local governments abroad to be paid by companies in the energy sector;

- Group net ordinary income is determined by rectifying “Group net income” from the items relating to “ordinary EBIT”[6], taking into account any tax effects and non-controlling interests. Furthermore, it excludes certain financial components not strictly attributable to the Group’s core operations;

- Net financial debt is an indicator of the financial structure, determined by:

- “Long-term borrowings”, “Short-term borrowings”, and “Current portion of long-term borrowings”, “Other non-current financial liabilities” and “Other current financial liabilities included in net financial debt” included in “Other current financial liabilities”;

- net of “Cash and cash equivalents”;

- net of “Other current financial assets included in net financial debt” included in “Other current financial assets”, which includes: (i) current financial receivables, (ii) the current portion of long-term loan assets, and (iii) securities;

- net of “Other non-current financial assets included in net financial debt” included in “Other non-current financial assets”, which includes (i) financial receivables and (ii) securities.

More generally, the net financial debt of the Enel Group is reported in accordance with the provisions of Guideline no. 39, issued on March 4th, 2021 by ESMA, applicable as from May 5th, 2021, and with the above Warning Notice no. 5/21 issued by CONSOB on April 29th, 2021.

*****

[1] With all planned deals already closed or to be closed by year-end.

[2] In core countries.

[3] Calculated on mid-point of the guidance range.

[4] On a like-for-like basis, excluding the impact from disposals and the capital gains relating to Stewardship business.

[5] As an indicator of the operating performance, EBITDA is calculated as the sum of “EBIT”, “Net impairment /(reversals) of trade receivables and other receivables” and “Depreciation, amortization and other impairment”.

[6] Defined as EBIT integrated with the ordinary operating results of discontinued operations and stripped of the effects of non-core operations commented on in relation to ordinary EBITDA. Significant impairments are also excluded (including related reversals of impairment losses) recognized on assets and/or groups of assets, as a result of an assessment of the recoverability of their carrying amount, in accordance with “IAS 36 - Impairment of Assets” or “IFRS 5 - Non-current Assets Held for Sale and Discontinued Operations”.