Enel: solid results in 2023 with ordinary ebitda at 22 billion euros (+11.6%) and net ordinary income at 6.5 billion euros (+20.7%). Funds from operations up by 63% versus 2022, 3 billion euros more than the Enel Group’s highest historical level

The excellent performance recorded in 2023 allowed the Group to achieve 2023 targets revised upwards last november. Dividend at 0.43 euros per share (+7.5%).

MAIN CONSOLIDATED ECONOMIC AND FINANCIAL DATA

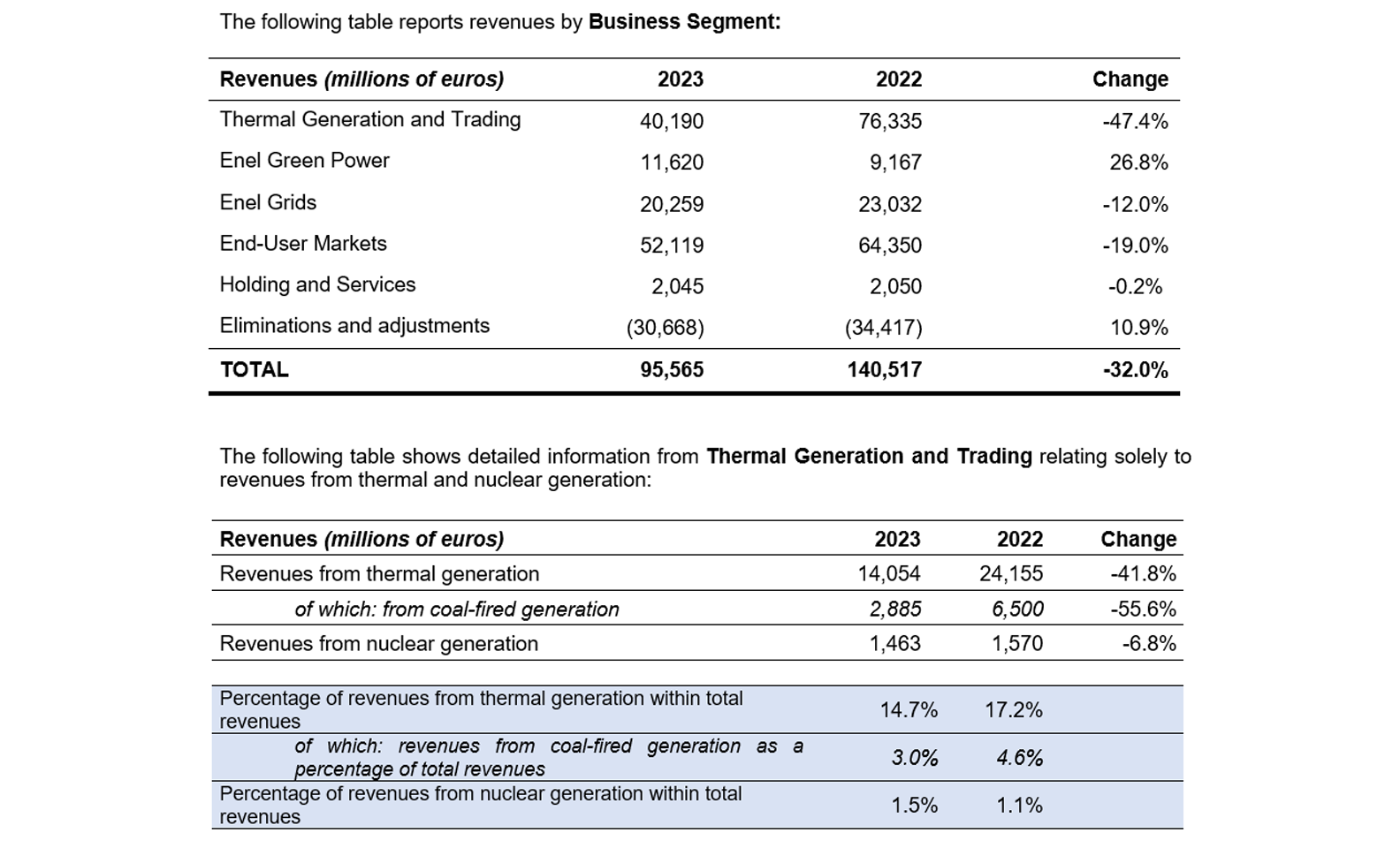

- Revenues: 95,565 million euros (140,517 million euros in 2022, -32%). The change is mainly attributable to the lower average sale prices against a framework characterized by a gradual normalization of the energy sector compared to 2022, as well as to the different scope of consolidation.

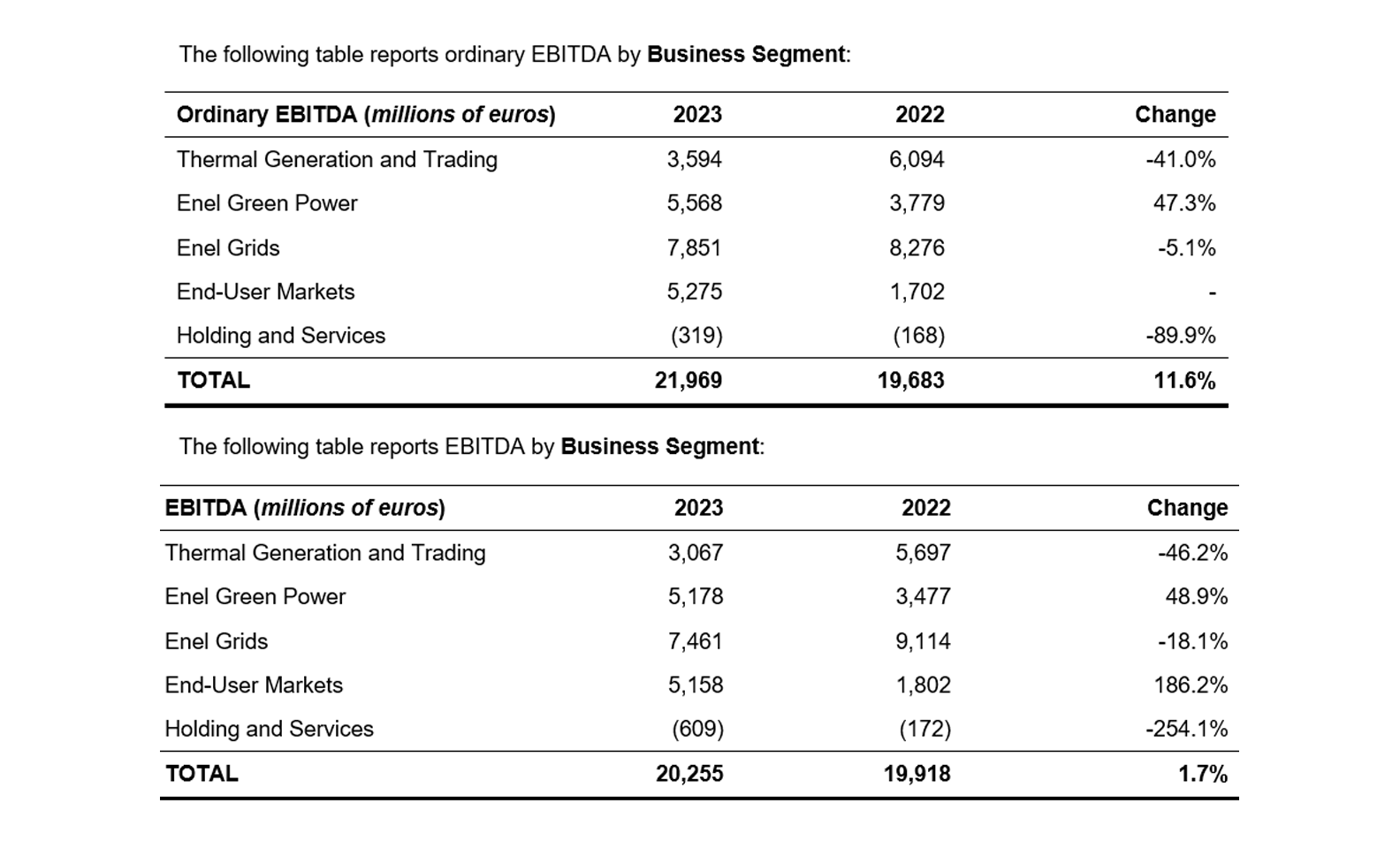

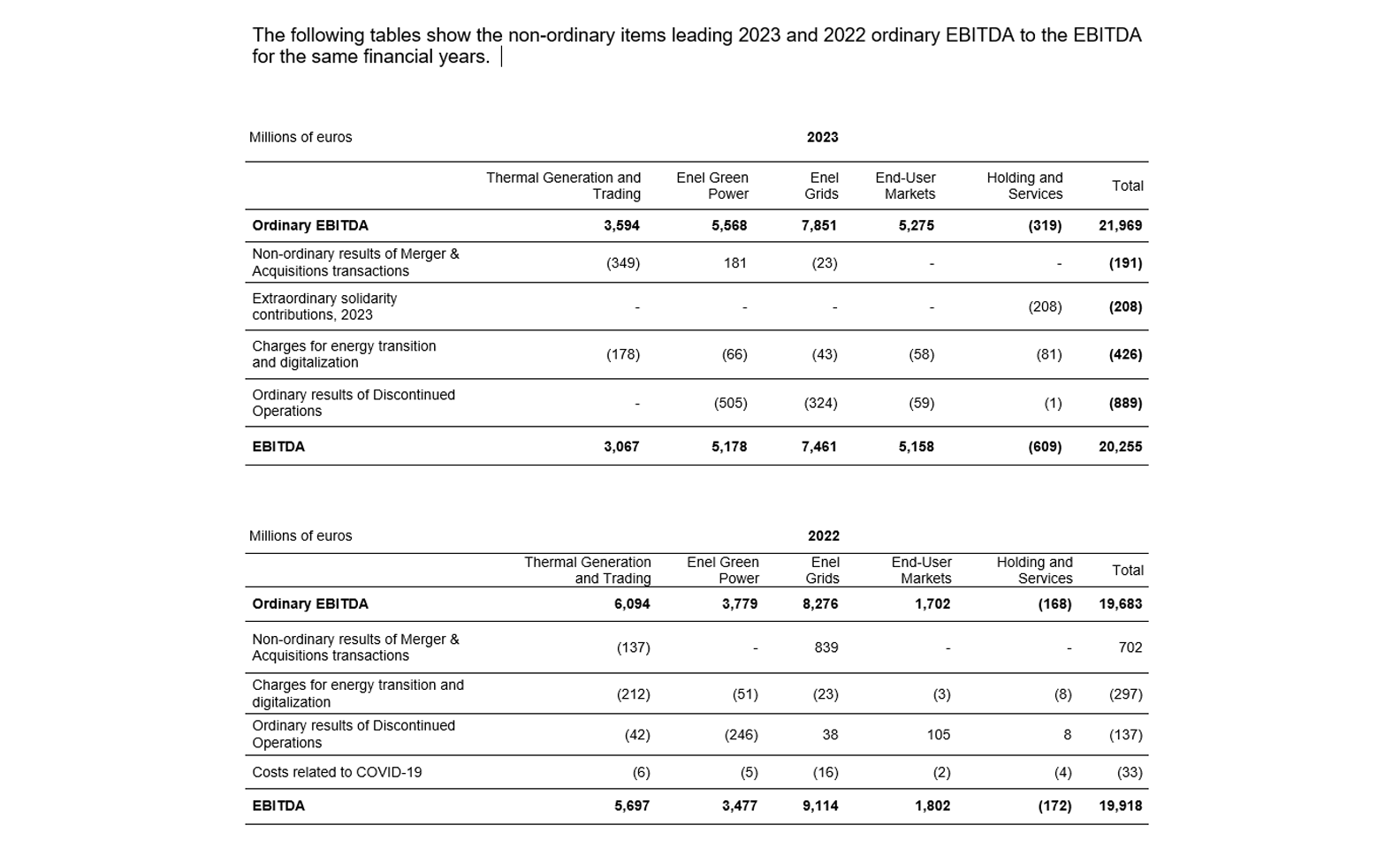

- Ordinary EBITDA: 21,969 million euros (19,683 million euros in 2022, +11.6%). The increase is attributable to the positive result of the integrated businesses and of distribution activities, net of changes in the scope of consolidation and of Stewardship transactions compared to the previous year.

- EBITDA: 20,255 million euros (19,918 million euros in 2022, +1.7%).

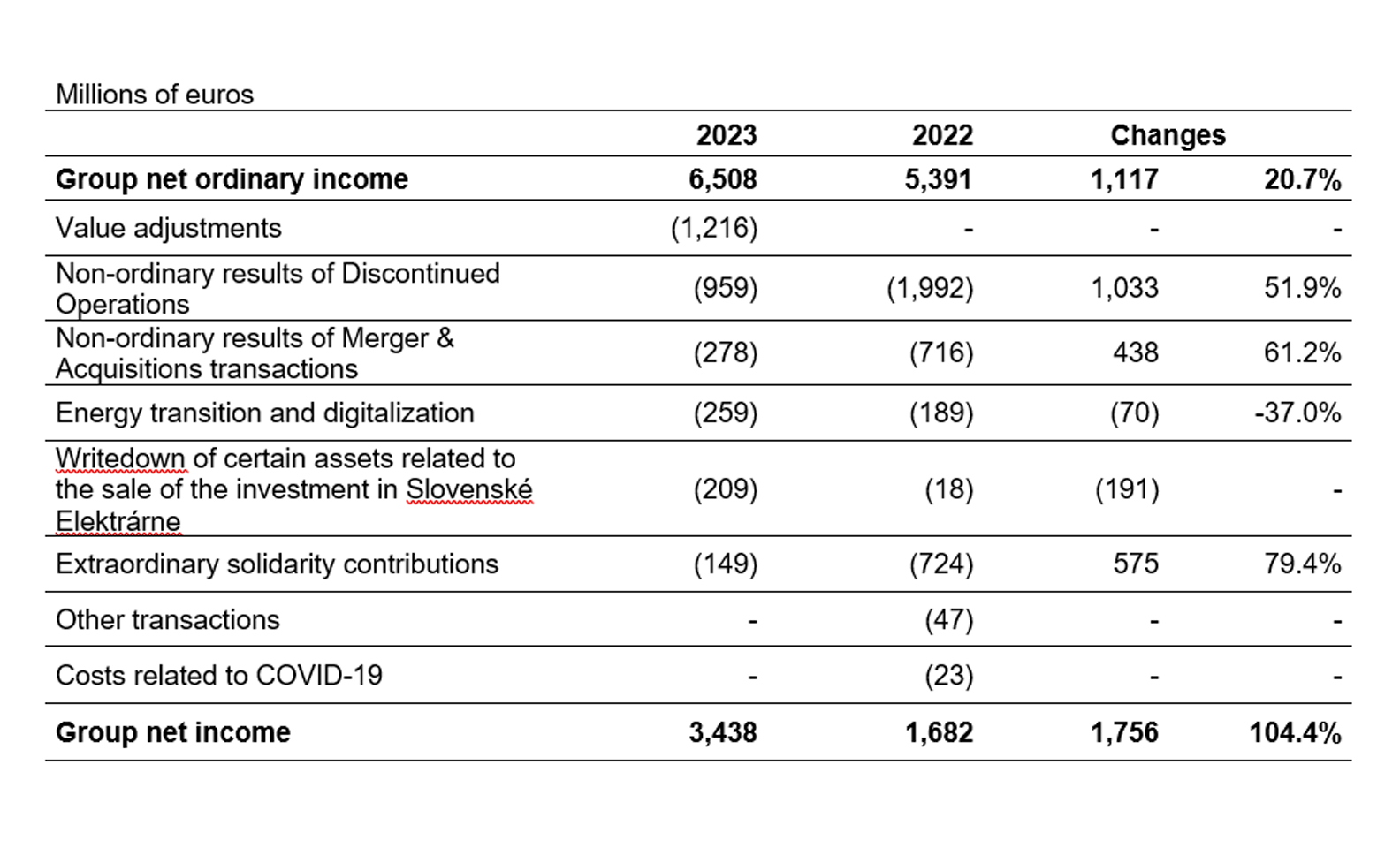

- Group net ordinary income: 6,508 million euros (5,391 million euros in 2022, +20.7%). The increase is attributable to the positive performance of ordinary operations and the lower incidence of non-controlling interests, which more than offset the increase in net financial expense due to market interest rate evolution compared to the previous year, as well as the higher tax charges, attributable to the improvement of results.

- Group net income: 3,438 million euros (1,682 million euros in 2022, +104.4%).

- Net financial debt: 60,163 million euros (60,663 million euros in 2022, -0.8%). The positive cash flow generated by operations, the sale of certain equity investments no longer considered strategic, the effects associated to the issuance of non-convertible subordinated perpetual hybrid bonds and the reporting of contributions supporting capital expenditure more than offset the needs generated by capital expenditure in the period, and the payment of dividends. Net financial debt/ordinary EBITDA: approximately 2.7x (compared to 3.1x in 2022).

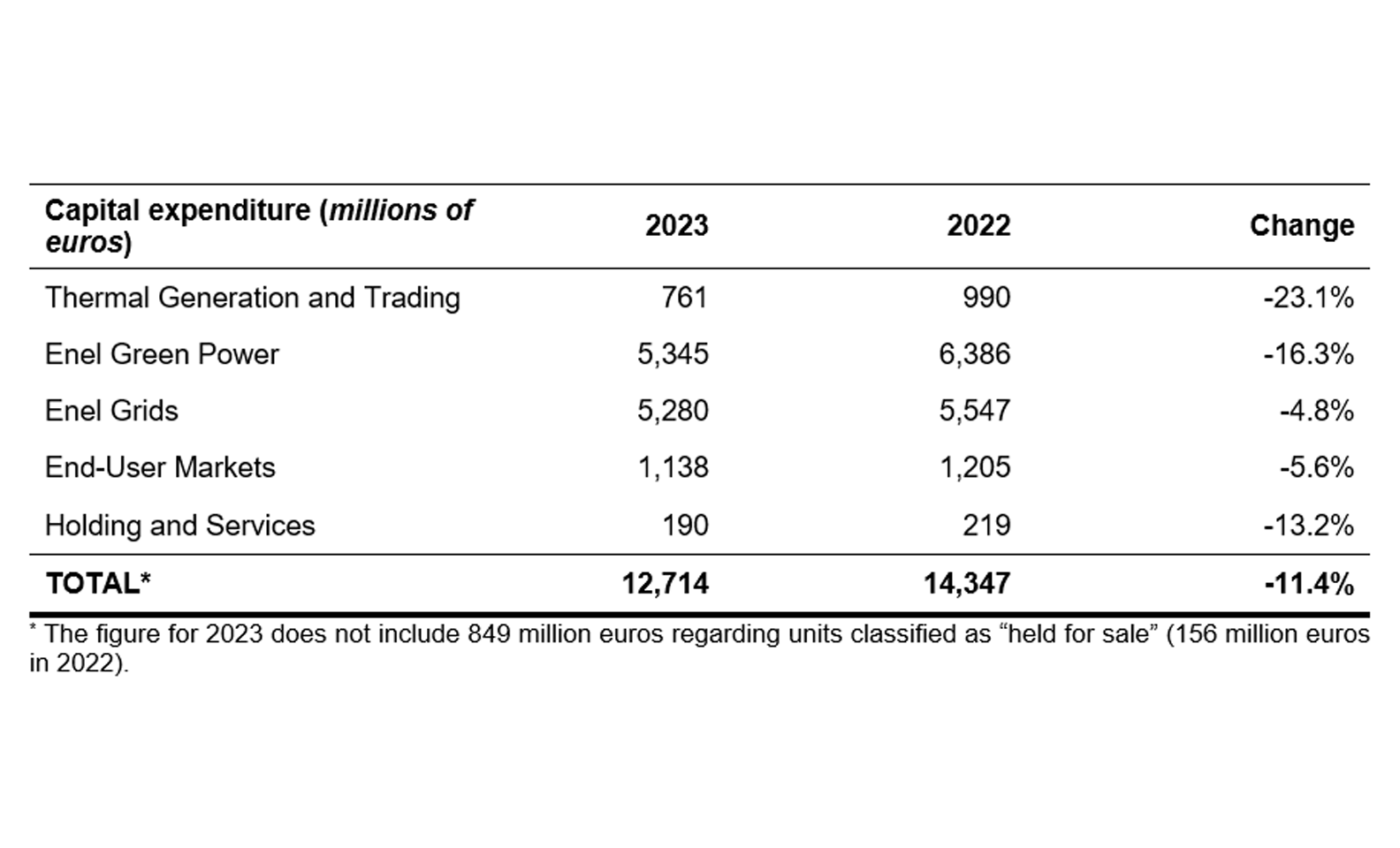

- Capital expenditure: 12,714 million euros (14,347 million euros in 2022, -11.4%). The change is attributable to the difference in the scope of consolidation compared with 2022 as well as to the focus of investments on the development of distribution networks and renewable capacity, mainly in Europe.

- The total dividend proposed for the entire financial year 2023 is 0.43 euros per share (of which 0.215 euros per share were already paid as an interim payment in January 2024), a 7.5% increase on the total dividend of 0.40 euros per share recognized for the full financial year 2022.

2023 results and objectives of the Group’s Strategic Plan

All strategic objectives for 2023 achieved

Group ordinary EBITDA and net ordinary income in line with guidance, revised upwards in November 2023;

Managerial actions implemented resulted in a significant improvement in cash flow generation with an FFO (Funds From Operations) of approximately 14.8 billion euros, recording an increase of about 5.7 billion euros compared to 2022 (around +63%). FFO is 3 billion euros more than the Enel Group’s highest historical level;

Significant progress in the Group's rationalization process with over 90% of the disposal target set in November 2023 already achieved, considering those already finalized and those announced so far;

Pro-forma net financial debt stands at approximately 53.5 billion euros; this figure also takes into account the sale of assets finalized after December 31st, 2023, as well as those already announced and not yet finalized, the financial effects of which will only appear after the completion of the usual authorization processes by the competent authorities. Therefore, the pro-forma net financial debt/ordinary EBITDA ratio is approximately 2.4x.

*****

“We achieved all 2023 targets that we had already revised upwards last November,” commented Flavio Cattaneo, Enel Group CEO. “These solid results clearly prove the effectiveness of the actions put in place by the new management in 2023, in line with our strategic priorities of optimizing the risk/return profile, efficiency and effectiveness, as well as both financial and environmental sustainability. We reaffirm our commitment to achieving the ambitious goals set during the presentation of the 2024-2026 Strategic Plan. Specifically, in line with what we announced last November, we reasonably expect that 2024 shareholder remuneration may grow further.”

*****

The Board of Directors of Enel S.p.A. (“Enel” or the “Company”), chaired by Paolo Scaroni, approved the 2023 results at today’s meeting in Rome.

Consolidated economic and financial data for 2023

REVENUES

Revenues in 2023 amounted to 95,565 million euros, a reduction of 44,952 million euros (-32%) compared with 2022. The decrease is mainly attributable to: (i) Thermal Generation and Trading, due to the lower volumes of energy produced resulting from the greater use of generation from renewable sources against a framework characterized by a higher level of stability of the energy sector alongside a scenario of declining average sale prices compared to 2022, mainly in Italy and Spain, as well as to the different scope of consolidation; (ii) End-User Markets, due to lower volumes sold at decreasing prices in Italy and Spain and due to the recognition in 2022 of the proceeds from the partial sale of the equity interest held in Ufinet for 220 million euros as well as from the sale of a number of equity investments of Enel X to Mooney Group in the amount of 67 million euros, effects that were only partially offset by the increase in revenues from electricity sales in Latin America, mainly in Colombia and Peru; (iii) Enel Grids, due to the change in the scope of consolidation resulting from the disposal in 2022 of Celg Distribuição SA (Celg-D) in Brazil and the proceeds, reported in the same year, related to the sale of 50% of the stake held in Gridspertise in Italy. These effects were partially offset by positive tariff adjustments in Italy and Latin America.

Enel Green Power revenues increased compared to 2022, mainly due to the increase in the quantities produced by hydropower, wind and solar sources in Italy, Spain, Latin America and North America, and to the proceeds deriving from the partial sale of equity investments held in a number of companies in Australia and Greece as part of the Stewardship transactions.

Revenues in 2023 from thermal generation alone and included in the results of Thermal Generation and Trading amounted to 14,054 million euros, a decrease of 10,101 million euros (-41.8%) compared with 2022. Specifically, revenues attributable to coal-fired generation in 2023 amounted to 3% of total revenues, a decrease from 4.6% in 2022.

Revenues for the financial year 2023 included non-ordinary income from the sale of certain photovoltaic plants in Chile, amounting to 195 million euros, while revenues for the financial year 2022 included non-ordinary income from the sale of transmission activities in Chile, amounting to 1,051 million euros.

ORDINARY EBITDA AND EBITDA

Ordinary EBITDA in 2023 amounted to 21,969 million euros, an increase of 2,286 million euros compared to 2022 (+11.6%), mainly due to the increase in the result from the performance of the integrated businesses (as a combination of the Thermal Generation and Trading, Enel Green Power and End-User Markets businesses) of 2,627 million euros, and to the better result posted by electricity distribution activities (Enel Grids) – net of changes in the scope of consolidation and of the income resulting from the partial sale of the equity stake held in Gridspertise (520 million euros), recorded in 2022 – essentially attributable to the tariff adjustments mainly recorded in Latin America.

Finally, the overall change in ordinary EBITDA reflects the different proceeds from Stewardship transactions completed in the two years under comparison. Specifically, the positive effects related to the partial disposals completed in 2023 of equity investments held in EGP Australia (103 million euros) and EGP Hellas (422 million euros) were lower than the proceeds from the transactions carried out in 2022 relating to the disposals of Ufinet (220 million euros) and of the companies in the financial segment of Enel X to Mooney Group (67 million euros), as well as to the abovementioned partial sale of the equity stake held in Gridspertise (520 million euros).

Specifically, the increase in 2023 ordinary EBITDA of the integrated business, amounting to 2,627 million euros, is mainly attributable to the improvement in margins on the free market, especially in Italy and Spain, in a context of gradual normalization of the energy sector compared to the previous financial year, which more than offset the negative effects of changes in the scope of consolidation in the two years under comparison and the reduction in thermal generation margin. Regarding the latter, the higher production of energy from renewable plants (+14.5 TWh), mainly from hydropower sources in Italy, Chile, Colombia and Spain, together with the difference in sale price in trading activities, partially offset the effects of the lower quantities of energy produced from thermal sources as well as the recognition of regulatory measures related to clawback in Italy for 357 million euros.

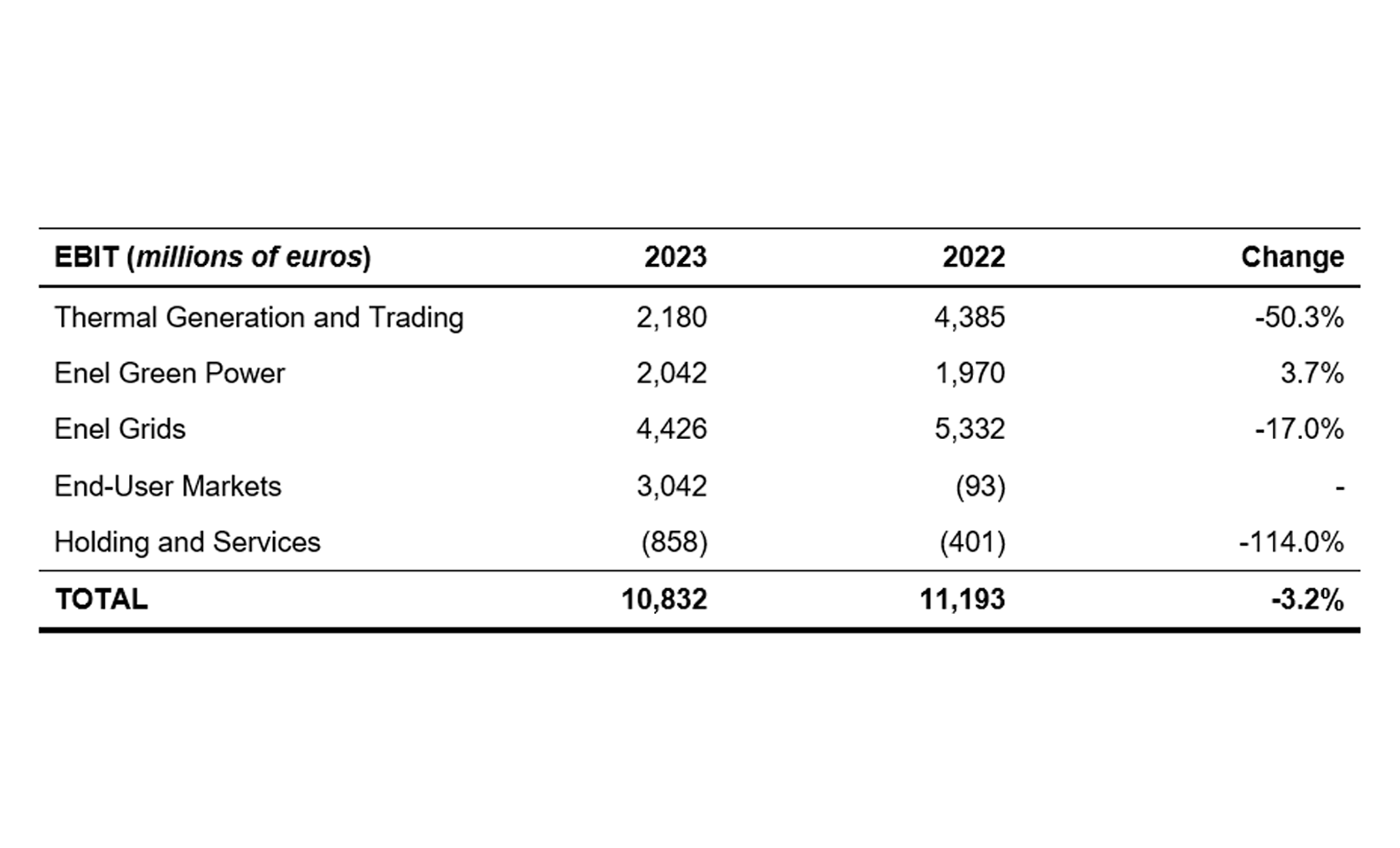

EBIT

The following table reports EBIT by Business Segment:

EBIT in 2023 amounted to 10,832 million euros, a decrease of 361 million euros (-3.2%) compared to the previous year. The effects of the positive performance of operations, taking into account the abovementioned different non-ordinary items in the periods under comparison, only partially offset higher depreciation and amortization on tangible and intangible assets as well as value adjustments recorded during 2023 compared with 2022.

Specifically, during the year, net value adjustments were carried out for a total of 1,736 million euros, of which 1,234 million euros related to certain wind and photovoltaic generation plants in the United States. These plants were subject to load recoverability checks mainly as a result of the persistence of unfavorable economic conditions related to the dispatching charges of energy produced on certain reference markets, which gradually consolidated during 2023, accompanied by a general worsening of the macroeconomic scenario. It should be noted that, in North America, a value adjustment of 57 million euros was also carried out on the activities of Enel X and of 69 million euros on the activities of Enel X Way and that, during the 2023 financial year, an impairment of 171 million euros was recognized on certain activities in Colombia.

The value adjustments recorded in 2022, equal to a total of 1,361 million euros, were carried out, in accordance with the provisions of the same IFRS 5 international accounting principles, on activities under disposal and mainly relating, in Brazil, to Celg-D (827 million euros) and CCGT Fortaleza (73 million euros), and, in Argentina, to Costanera (174 million euros) as well as Dock Sud (116 million euros).

GROUP ORDINARY NET INCOME AND NET INCOME

In 2023, Group net ordinary income amounted to 6,508 million euros, an increase of 1,117 million euros compared to 2022 (+20.7%). The positive performance of ordinary operations and the lower incidence of non-controlling interests on net ordinary income more than offset the increase in net financial expense due to evolution in interest rates (871 million euros), as well as the higher tax charges attributable to the improvement of results (589 million euros).

FINANCIAL POSITION

The financial position shows net capital employed at December 31st, 2023, including 3,603 million euros of net assets held for sale (2,789 million euros at December 31st, 2022), at 105,272 million euros (102,743 million euros at December 31st, 2022).

This amount is funded by:

- equity, including non-controlling interests, of 45,109 million euros (42,080 million euros at December 31st, 2022);

- net financial debt of 60,163 million euros (60,663 million euros at December 31st, 2022). The positive cash flow generated by operations, the effects of the issuance of non-convertible subordinated perpetual hybrid bonds, the sale of a number of equity investments no longer considered strategic, and the recognition of NRRP (National Recovery and Resilience Plan) grants in Italy to support capital expenditure offset investment requirements for the period (12,714 million euros[1]) and the payment of dividends (5,317 million euros). At December 31st, 2023, the ratio of net financial debt/ordinary EBITDA was approximately 2.7x, an improvement on the 3.1x in 2022.

At December 31st, 2023, the debt/equity ratio came to 1.33 (an improvement on 1.44 at December 31st, 2022).

CAPITAL EXPENDITURE

The following table reports capital expenditure by Business Segment:

Capital expenditure amounted to 12,714 million euros in 2023, a decrease of 1,633 million euros compared to 2022 (-11.4%). The change is essentially attributable to the difference in the scope of consolidation compared to 2022 and to the strategy to improve the risk/return profile of investments, with a greater focus on Europe. Capital expenditure was focused on Enel Green Power, mainly in wind and solar technologies in Italy, Spain, Brazil, Chile, Colombia, and the United States, as well as in Enel Grids, mainly in Italy, Spain, Brazil, Colombia, and Chile.

Finally, in the End-User Markets Business Segment, Enel X investments grew, mainly in Italy and Brazil.

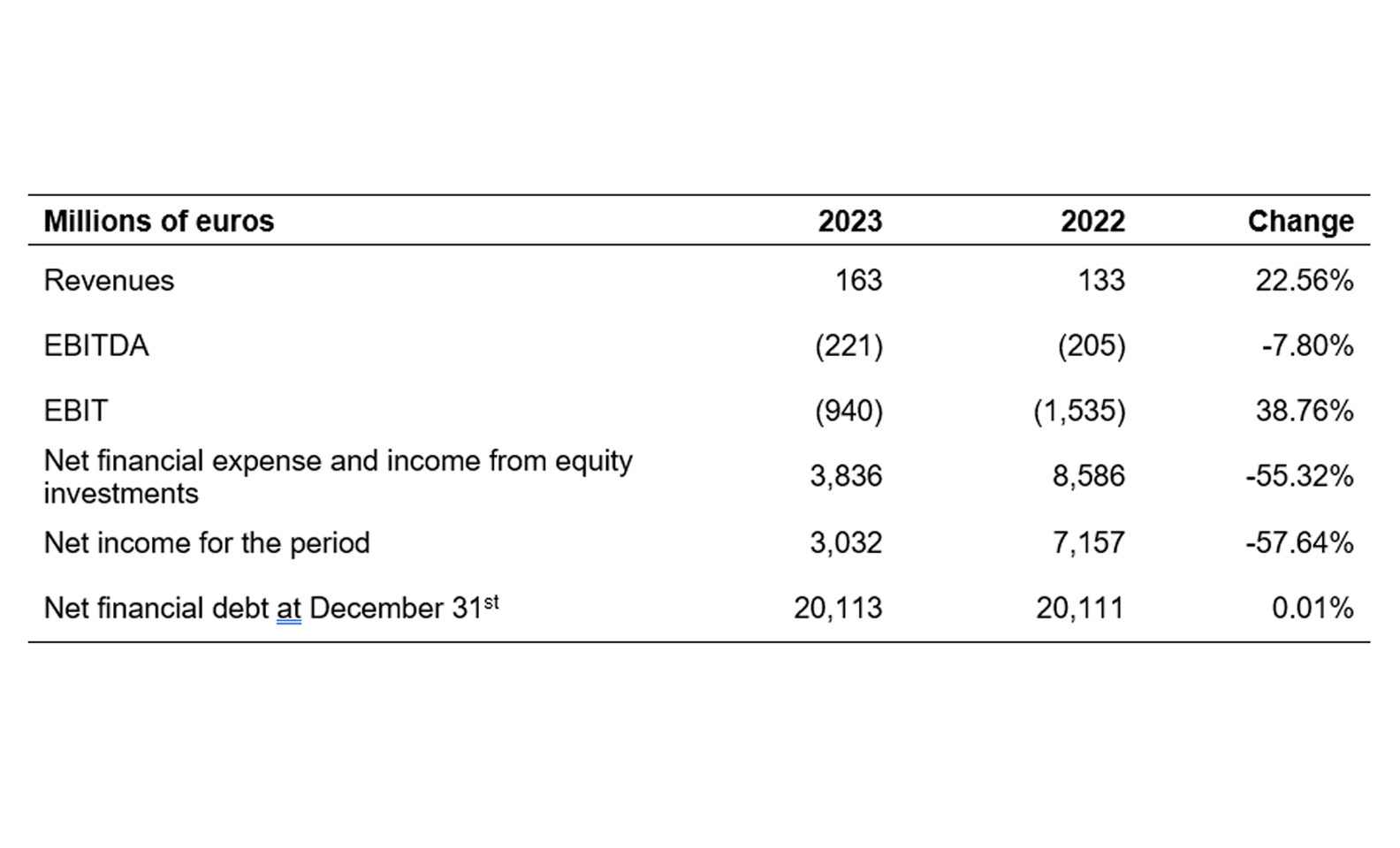

2023 Results of the Parent Company

The Parent Company Enel, in its capacity as industrial holding company, sets the strategic objectives for the Group and coordinates the activities of its subsidiaries. The activities that Enel performs in respect of the other Group companies as part of its management and coordination role are Holding activities (coordination of governance processes at Group level). Within the Group, Enel also directly performs the role of central treasury, ensuring access to the money and capital markets.

Main economic and financial data of the Parent Company in 2023:

- Revenues amounted to 163 million euros, with an increase of 30 million euros compared to 2022. The change is mainly attributable to the capital gain of 43 million euros recognized following the sale of some minority shareholdings, partially offset by the decrease of 9 million euros in revenues from sales and services relating to services rendered to subsidiaries as part of the Parent Company's role of guidance and coordination.

- EBITDA was a negative 221 million euros, a 16 million euro decrease on 2022. This decrease is due to higher personnel costs and other operating expenses, only partially offset by higher revenues.

- EBIT was a negative 940 million euros, net of depreciation, amortization and impairment related to equity investments of 719 million euros (1,330 million euros in 2022). The increase of 595 million euros compared to 2022 is attributable to lower value adjustments on equity investments. Specifically, the value adjustments carried out in 2023 refer to the investment in Enel Green Power S.p.A. for 605 million euros. In the previous financial year, the “depreciation, amortization and impairment losses” figure included the value adjustments referring to subsidiaries in Romania, recorded under “Non-current assets classified as held for sale”, for a total of 995 million euros, to PJSC Enel Russia, sold in October 2022 for 195 million euros, to investments in Enel Green Power S.p.A. of 228 million euros and in Enel Innovation Hubs S.r.l. of 16 million euros, net of the reversal of impairment of the shareholding in Enel Global Trading S.p.A. of 162 million euros.

- Net financial expenses and income from equity investments were, overall, a positive 3,836 million euros (8,586 million euros in 2022) and include net financial expenses of 433 million euros (184 million euros in 2022) as well as income from investments in subsidiaries, associates and other companies of 4,269 million euros (8,770 million euros in 2022). Specifically, net financial expenses increased by 249 million euros, mainly due to the decrease in net financial income from derivative instruments (133 million euros), alongside the increase in interest expense on bank borrowings and certain intragroup borrowings (215 million euros), whose effects were partially offset by lower interest on bonds (57 million euros), and by the positive change in interest income on short-term financial assets (52 million euros). Income from equity investments decreased by 4,501 million euros, mainly due to the lower distribution of dividends by Enel Italia S.p.A., partially offset by the greater profits distributed by Enel Iberia S.r.l.u. and Enel Chile S.A.

- Net income for the year was 3,032 million euros, compared to 7,157 million euros in 2022 (-57.64%). The change of 4,125 million euros is mainly attributable to the reduction in income from equity investments, partially offset by lower value adjustments on shareholdings.

- Net financial debt at December 31st, 2023 was 20,113 million euros, in line compared to December 31st, 2022 (+0.01%). Net long-term financial debt decreased by 340 million euros, substantially offset by higher net short-term debt exposure of 342 million euros.

Equity amounted to 37,883 million euros, a decrease of 459 million euros compared to December 31st, 2022. Specifically, this change is mainly attributable: (i) to the comprehensive income for the 2023 financial year of 2,972 million euros; (ii) to the distribution of the balance of the dividend for 2022 in the amount of 0.20 euros per share (a total of 2,033 million euros), as resolved by the Shareholders’ Meeting on May 10th, 2023, and to the interim dividend for 2023 resolved by the Board of Directors on November 7th, 2023, in payment from January 24th, 2024 (0.215 euros per share, a total of 2,186 million euros); (iii) to the issuance of perpetual hybrid bonds for 986 million euros; (iv) to the provision to holders of perpetual hybrid bonds of coupons with a total value of 182 million euros.

Operational highlights for 2023

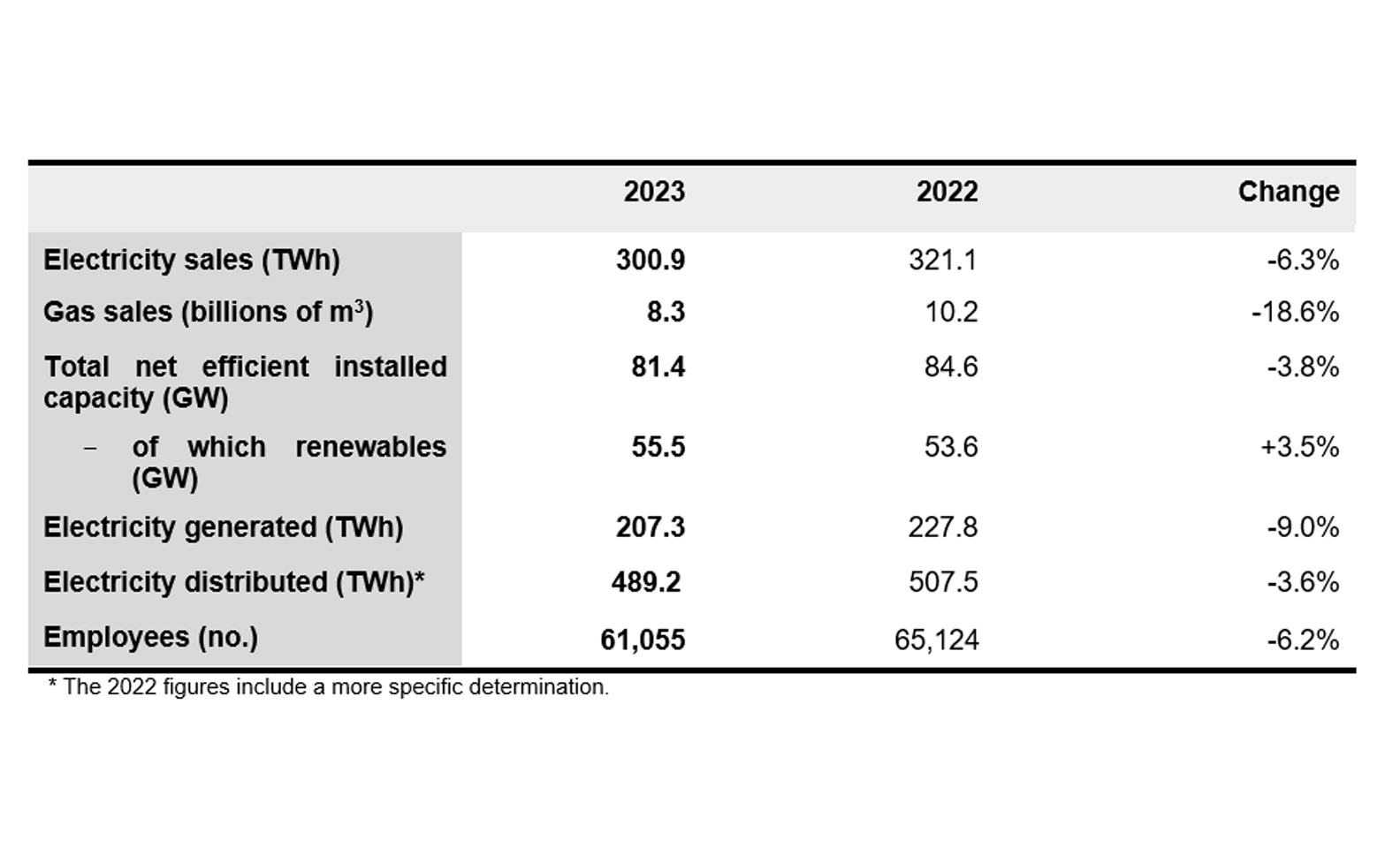

ELECTRICITY AND GAS SALES

- Electricity sales in 2023 amounted to 300.9 TWh, a decrease of 20.2 TWh (-6.3%; -2% on a like-for-like basis) compared to the previous financial year. Specifically, this reflects: greater quantities sold in Chile (+0.6 TWh), Peru (+0.5 TWh), Argentina (+0.4 TWh) and Colombia (+0.1 TWh), as well as lower volumes sold in Italy (-10 TWh), Brazil (-7.5 TWh), Romania (-3 TWh) and Iberia (-1.3 TWh);

- Natural gas sales in 2023 amounted to 8.3 billion cubic meters, a decrease of 1.9 billion cubic meters (-18.6%) compared to the previous year.

TOTAL NET EFFICIENT INSTALLED CAPACITY

At the end of December 2023, the Group’s total net efficient installed capacity amounted to 81.4 GW, a decrease of 3.2 GW compared to 2022. This decrease is attributable to the reduction in the thermal net efficient installed capacity due to the sale of Enel Generación Costanera and Dock Sud in Argentina (-3.1 GW) and to the decommissioning of some plants in Italy and Spain (2 GW), partially offset by higher renewable capacity, specifically solar of 2.9 GW (Peru, Chile, Brazil, Italy, Spain, Colombia, and the United States) and wind power of 1.2 GW (Brazil, Chile, and Peru).

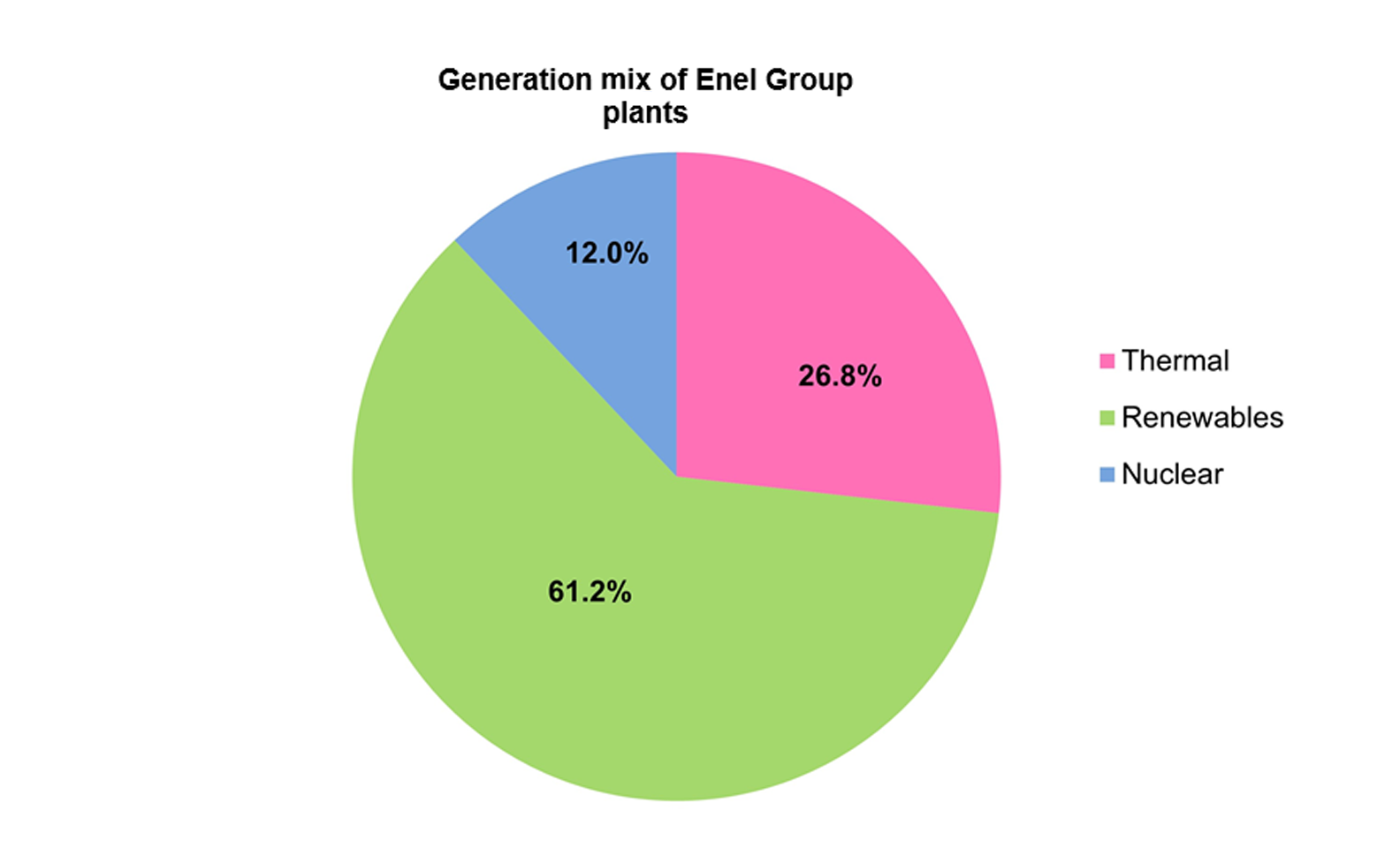

ELECTRICITY GENERATED

The net electricity generated by the Enel Group in 2023 amounted to 207.3 TWh[1], a decrease of 20.5 TWh compared to 2022 (-9%, -1% on a like-for-like basis). Specifically, this reflects:

- an increase in production from renewable sources by 14.5 TWh compared to the quantity produced in 2022 (+9.2 TWh hydro; +2.1 TWh wind; +3.3 TWh solar; -0.1 TWh geothermal);

- a decline in the contribution from thermal sources (-33.4 TWh), due to reduced generation from combined cycle plants (-17.8 TWh), from coal (-9 TWh), and from Oil & Gas (-6.6 TWh);

- a decrease in nuclear generation (-1.6 TWh).

Electricity generation from renewable sources, including volumes produced by managed capacity, far exceeded that from thermal generation, reaching 140.3 TWh (123.7 TWh in 2022, +13.4%), compared with thermal generation of 55.5 TWh (88.8 TWh in 2022, -37.5%).

Considering only the production from consolidated capacity, zero-emission generation comes to 73.2% of total generation of the Enel Group, while it is equal to 74.9% if managed generation capacity is also included[2]. The Enel Group’s long-term ambition is to achieve zero direct and indirect emissions by 2040.

ELECTRICITY DISTRIBUTED

Electricity transported on Enel Group distribution networks in 2023 amounted to 489.2 TWh, of which 214.1 TWh in Italy and 275.1 TWh abroad.

The volume of electricity distributed in Italy decreased by 6.3 TWh (-2.9%) compared to 2022, in line with the demand for electricity on the national grid (-2.8%). The percentage change in demand on the national market amounted to -4.9% in the North, -1% in the Center, -1.1% in the South and -0.9% in the Islands. The South and the Islands are mainly served by e-distribuzione; in the Center and North, other major operators account for a total of about 15% of volumes distributed.

Electricity distributed outside of Italy amounted to 275.1 TWh, a decrease of 12 TWh (-4.2%) compared to the volumes recorded in 2022.

EMPLOYEES

At December 31st, 2023, Group employees numbered 61,055 (65,124 at December 31st, 2022). The change in 2023 is mainly attributable to changes in scope of consolidation (-3,868 units).

STRATEGIC PLAN: PROGRESS ON THE FUNDAMENTAL PRINCIPLES

The Enel Group achieved all the targets set for 2023 in its Strategic Plan, some of which were revised upwards in November of the same year, when the Interim Financial Report at September 30th, 2023 was approved, therefore confirming the Group’s focus on the delivery of actions and strategies supporting short, medium and long-term objectives. Specifically, the following progress has been made in the implementation of the Group Strategy:

- Group ordinary EBITDA and net ordinary income were in line with Group guidance;

- The managerial actions implemented, with a specific focus on financial discipline and on the improvement of the operating performance of the business allowed the Group to significantly increase cash flow generation with an FFO (Funds From Operations) of approximately 14.8 billion euros, an increase of about 5.7 billion euros compared to 2022 (around +63%) and 3 billion euros higher than the historical performances reported by the Enel Group;

- The Group has continued its process of rationalizing its business portfolio and geographical areas, and has currently achieved more than 90% of the disposal target set in November 2023 during the presentation to the financial markets of the 2024-2026 Strategic Plan, considering both the asset disposals finalized and those announced so far and not yet finalized;

- Pro-forma net financial debt stands at approximately 53.5 billion euros. This figure also takes into account the sale of assets finalized after December 31st, 2023, as well as those already announced and not yet finalized, the financial effects of which will only appear after the completion of the usual authorization processes by the competent authorities. Therefore, the pro-forma net financial debt/ordinary EBITDA ratio is approximately 2.4x.

In terms of shareholder remuneration, the total dividend proposed for the 2023 financial year is 0.43 euros per share, 7.5% higher than the dividend distributed in 2022.

OUTLOOK

In November 2023, the Group presented to the financial community its new Strategic Plan for the 2024-2026 period, based on three pillars:

- Profitability, flexibility, and resilience through selective capital allocation to maximize Group risk/return profile;

- Efficiency and effectiveness driving Group operations, based on simplified processes, a leaner organization with clear accountability and focus on core geographies as well as cost discipline;

- Financial and environmental sustainability to pursue value creation while addressing the challenges of climate change.

Between 2024 and 2026, the Group has planned a total gross capex of approximately 35.8 billion euros:

- around 18.6 billion euros in Grids, focusing on improving quality, resilience and digitalization, alongside new connections;

- approximately 12.1 billion euros in Renewables, focusing on onshore wind, solar and battery storage while also leveraging on repowering;

- about 3 billion euros in Customers, actively managing Group customer portfolio through multi-play bundled offers, which encompass commodities and services within an integrated portfolio provided through a single touchpoint.

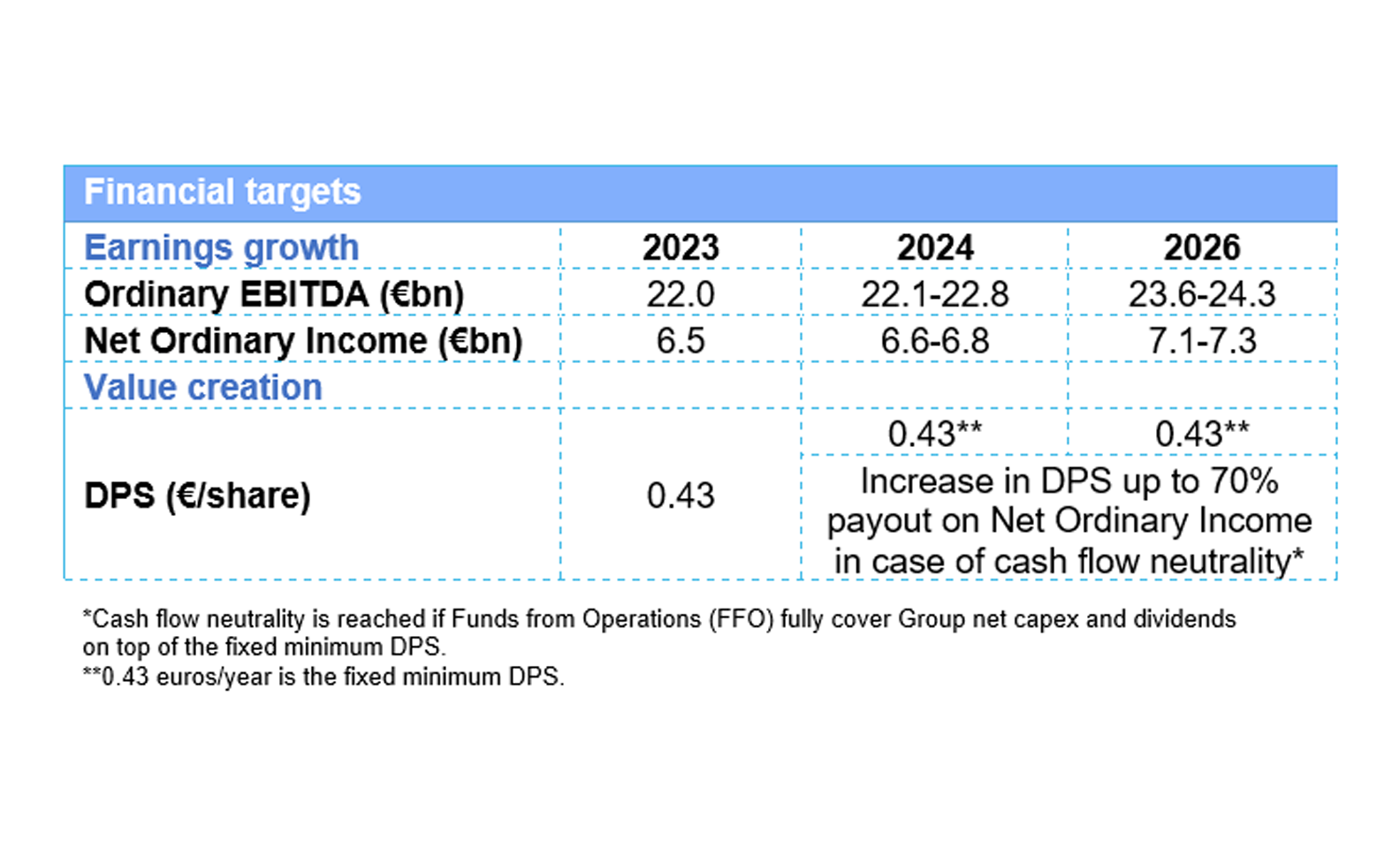

As a result of the abovementioned strategic actions, in 2026 Group ordinary EBITDA is expected to grow to between 23.6 and 24.3 billion euros, and Group net ordinary income is expected to increase to between 7.1 and 7.3 billion euros.

The dividend policy foresees a fixed minimum DPS (“Dividend Per Share”) of 0.43 euros for the 2024-2026 period with a potential increase up to a 70% payout on Net Ordinary Income, if cash flow neutrality is achieved*.

In 2024 Enel plans:

- investments in distribution networks focused on geographical areas with a more balanced and clearer regulatory framework, especially in Italy;

- selective investments in renewables, aimed at maximizing the return on invested capital and minimizing risks;

- active management of the customer portfolio through multi-play bundled offers.

As a result of the above, the following table sets out the economic and financial targets on which the Group’s 2024-2026 Plan is based.

Authorization to purchase and dispose of treasury shares

Enel’s Ordinary Shareholders’ Meeting of May 10th, 2023 authorized the Board of Directors to purchase and subsequently dispose of the Company’s treasury shares for 18 months as from the date of the shareholders' resolution. On October 5th, 2023, the Board of Directors, in implementation of this authorization, approved the start of a buy-back program to purchase 4.2 million treasury shares, equivalent to approximately 0.041% of Enel’s share capital, to serve the 2023 Long-Term Incentive Plan reserved to the top management of Enel and/or its subsidiaries pursuant to Art. 2359 of the Italian Civil Code approved by the same Shareholders’ Meeting of May 10th, 2023, pursuant to Art. 114-bis of the Consolidated Financial Act. Following the purchases made in execution of the aforementioned Board resolution, the Company purchased a total of 4.2 million treasury shares, equal to approximately 0.041% of the share capital. Taking into account the 7,153,795 treasury shares already in the portfolio, as well as the disbursement on September 5th, 2023 of a total of 1,268,689 Enel ordinary shares to the beneficiaries of the long-term incentive plan for 2019 and 2020 reserved to the management at Enel and/or its subsidiaries pursuant to Art. 2359 of the Italian Civil Code, the Company currently holds 10,085,106 treasury shares, equal to approximately 0.10% of the share capital, while the subsidiaries do not hold Enel shares.

In view of the persistence of the reasons justifying the aforementioned authorization granted by the Ordinary Shareholders' Meeting of May 10th, 2023 and the approaching expiry date set by the latter, the Board of Directors has therefore deemed it appropriate to submit to the Shareholders’ Meeting – convened, as indicated below, for May 23rd, 2024 – the renewal of the authorization to purchase and subsequently dispose of treasury shares – subject to revocation of the previous authorization – to be carried out in one or more installments, up to a maximum of 500 million ordinary shares in the Company, representing approximately 4.92% of Enel’s share capital, a total outlay of up to 2 billion euros.

The purchase and disposal of treasury shares is intended: (i) to offer shareholders an additional tool for monetizing their investment; (ii) to operate on the market with a medium and long-term investment view; (iii) to fulfil the obligations arising from the 2024 Long-Term Incentive Plan reserved to the top management of Enel and/or its subsidiaries pursuant to Article 2359 of the Italian Civil Code - which provides for a portion of the bonus, if accrued, to be paid in Enel shares and which will be submitted for approval to the Shareholders' Meeting called for May 23rd, 2024 - and/or from any other equity plans for Directors or employees of Enel or its subsidiaries or affiliates; (iv) to support the market liquidity of the Enel share in such a way as to favor the regularity of trading and to avoid irregular price fluctuations, as well as to regularize the trend of negotiations and quotations, against the temporary distortions linked to excessive volatility or low trading liquidity; and (v) to constitute a “securities warehouse” which may be used in the context of any possible extraordinary financial transactions or for other purposes deemed to be in the financial, managerial and/or strategic interest for Enel.

The purchase of treasury shares will be allowed for eighteen months from the date of the shareholders’ resolution authorizing it; on the other hand, there is no time limit for the disposal of purchased treasury shares.

Purchases of treasury shares may be made at a price to be determined on a case-by-case basis, taking into account the method chosen for carrying out the transaction and in compliance with any applicable regulatory provisions, as well as, where applicable, the accepted market practices in force pro tempore, it being understood that such price shall in any case not differ, either downwards or upwards, by more than 10% from the reference price recorded on the Euronext Milan market, organized and managed by Borsa Italiana S.p.A., on the day preceding each individual transaction. The sale or other disposal of treasury shares in portfolio, on the other hand, shall take place in accordance with the terms and conditions established from time to time by the Board of Directors, in compliance with the limits that may be provided for by the laws in force, as well as, where applicable, by the accepted market practices in force pro tempore.

Purchases of treasury shares may be made according to one of the following operating modalities identified by Article 144-bis, paragraphs 1 and 1-bis of the CONSOB Issuers’ Regulations: (i) by means of a public tender or exchange offer; (ii) on regulated markets or Multilateral Trading Facilities (MTFs), in accordance with operating modalities set out in the rules for the organization and management of those markets, which do not allow direct matching of purchase offers with predetermined sales; (iii) by means of the purchase and sale of derivative instruments traded on regulated markets or MTFs that provide for the physical delivery of the underlying shares, provided that the market’s organizational and management rules establish trading arrangements for such instruments in line with the characteristics defined in Article 144-bis, paragraph 1, letter c) of the CONSOB Issuers’ Regulation; (iv) in the manner established by the market practices accepted by CONSOB pursuant to Article 13 of Regulation (EU) No 596/2014; (v) under the conditions set out in Article 5 of Regulation (EU) no. 596/2014.

The sale or other disposal of treasury shares may, on the other hand, take place in the manner deemed most appropriate by the Board of Directors and compliant with the interest of the Company and, in any case, in accordance with the relevant applicable laws and, where applicable, with the accepted market practices in force pro tempore.

Shareholders’ meeting and dividend

The Board of Directors has also convened the Ordinary Shareholders’ Meeting for May 23rd, 2024, on single call, in order to:

1. Approve the financial statements and examine the consolidated financial statements as well as the consolidated non-financial statement related to the 2023 financial year.

2. Resolve upon the distribution of a total dividend of 0.43 euros per share, of which:

a) 0.215 euros per share taken from Enel’s net income, to cover the interim dividend for the 2023 financial year, in payment from January 24th, 2024;

b) 0.065 euros per share taken from Enel's net income as the balance of the 2023 dividend;

c) 0.15 euros per share taken from the available reserve called “retained earnings”, again as the balance of the dividend for the 2023 financial year.

The total dividend therefore amounts to approximately 4,372 million euros, in line with the dividend policy for the 2023 financial year announced to the market, which envisages the payment of a total fixed dividend for 2023 of 0.43 euros per share. In this regard, it should be noted that the Board of Directors, in its meeting of November 7th, 2023, resolved to distribute an interim dividend for the 2023 financial year of 0.215 euros per share, the payment of which was carried out as from January 24th, 2024, with the “ex-dividend date” of coupon no. 39 coinciding with January 22nd, 2024 and record date (i.e., the date of the title to the payment of the dividend itself) coinciding with January 23rd, 2024. In accordance with the law, treasury shares in Enel’s portfolio on the latter record date did not participate in the distribution of said interim dividend. As regards the balance of the dividend for 2023, equal to 0.215 euros per share, the Board of Directors has proposed a payment date as from July 24th, 2024, with the “ex-dividend date” of coupon no. 40 coinciding with July 22nd, 2024 and record date coinciding with July 23rd, 2024. In line with the legislation in force, treasury shares in Enel’s portfolio at the record date indicated above will not be accounted for in the balance dividend.

3. Resolve upon the authorization to purchase and dispose of treasury shares, subject to the revocation of the authorization granted by the Ordinary Shareholders’ Meeting of May 10th, 2023.

4. Resolve upon the adoption of a long-term incentive plan (“Incentive Plan”), characterized by a three-year vesting period, which grants the relevant recipients a bonus consisting of a component in Enel shares and a monetary component, subject to and in proportion to the achievement of the following performance objectives over the 2024-2026 period: (i) Total Shareholders’ Return (“TSR”), measured with reference to the performance of Enel’s share compared with that of the Euro Stoxx Utilities – UEM index; (ii) ROIC (Return on Invested Capital) - WACC (Weighted Average Cost of Capital); (iii) GHG “Scope 1 and Scope 3” emissions intensity related to the Group’s Integrated Power (gCO2eq/kWh) in 2026 (“GHG Scope 1 and Scope 3 emissions”), subject to exceeding a gateway objective concerning the GHG “Scope 1” emissions intensity related to Group’s Power Generation (gCO2eq/kWh) in 2026; (iv) percentage of women in management and middle management compared to the total population of managers and middle managers at the end of 2026. In particular, the Incentive Plan – which assigns a weighting of 45% to TSR, a weighting of 30% to ROIC–WACC, a weighting of 15% to GHG Scope 1 and Scope 3 emissions and a weighting of 10% to the percentage of women in management and middle management compared to the total population of managers and middle managers at the end of 2026 - is aimed at the Chief Executive Officer and Executives with strategic responsibilities of Enel, as well as managers of Enel itself and/or its subsidiaries pursuant to Article 2359 of the Italian Civil Code, as identified at the time of the assignment of the same Plan. Moreover the Plan, in view of the characteristics of its structure, the performance objectives identified, and the weight given to each of them, is also aimed at reinforcing the alignment of management interests with the priority objective of creating sustainable value for shareholders over the long term.

For a detailed description of the Incentive Plan, please refer to the information document, drafted pursuant to Article 114-bis of the Consolidated Finance Act and Article 84-bis of the CONSOB Issuers’ Regulation, which will be made available to the public in accordance with the law.

5. Adopt, with reference to the report on remuneration policy and compensations paid: (i) a binding resolution on the first section of the report itself, which illustrates Enel’s policy on the remuneration of Directors, General Manager, Executives with strategic responsibilities and members of the Board of Statutory Auditors for the 2024 financial year, as well as the procedures used for the adoption and implementation of such policy; (ii) a non-binding resolution on the second section of the report itself, that describes the compensations paid to Directors, General Manager, Executives with strategic responsibilities and members of the Board of Statutory Auditors in the 2023 financial year.

The documentation relating to the items on the agenda of the Shareholders' Meeting, as required by current legislation, will be made available to the public within the terms of the law.

Bond issues and maturing bonds

The main bond issues made in 2023 by Enel Group companies include:

- a multi-tranche non-convertible subordinated perpetual hybrid bond for a total value of 1,750 million euros issued by Enel in January 2023 with no fixed maturity, only due in the event of winding up or liquidation of the Company, structured as follows:

- 1,000 million euros, at a fixed annual coupon rate of 6.375% until the first reset date on July 16th, 2028;

- 750 million euros, at a fixed annual coupon rate of 6.625% until the first reset date on July 16th, 2031.

- a multi-tranche “Sustainability-Linked bond”, guaranteed by Enel, for a value of 1,500 million euros, with repayment in a single installment, issued in February 2023 by Enel Finance International, structured as follows:

- 750 million euros, at a fixed rate of 4.000% and maturing in February 2031;

- 50 million euros, at a fixed rate of 4.500% and maturing in February 2043;

- a bond for a value of 950 million Brazilian reals (equivalent to 177 million euros at December 31st, 2023), maturing in January 2026 and which provides for the payment of a floating-rate coupon CDI + 1.48%, issued in January 2023 by Enel Distribuição Ceará;

- a bond for a value of 500 million Brazilian reals (equivalent to 93 million euros at December 31st, 2023), maturing in May 2024 and which provides for the payment of a floating-rate coupon CDI + 1.65%, issued in May 2023 by Enel Distribuição Ceará;

- a bond for a value of 650 million Brazilian reals (equivalent to 121 million euros at December 31st, 2023), maturing in June 2024 and which provides for the payment of a floating-rate coupon CDI + 1.65%, issued in June 2023 by Enel Distribuição Ceará.

In the period between January 1st, 2024 and June 30th, 2025, bonds issued by Enel Group companies are expected to mature for a total amount of 8,843 million euros, including:

- 100 million euros relating to a floating-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in February 2024;

- 300 million Brazilian reals (equivalent to 56 million euros at December 31st, 2023) relating to a floating-rate bond issued by Enel Distribuição Ceará, maturing in March 2024;

- 400 million US dollars (equivalent to 362 million euros at December 31st, 2023) relating to a fixed-rate bond issued by Enel Generación Chile, maturing in April 2024;

- 750 million euros relating to a fixed-rate bond issued by Enel, maturing in May 2024;

- 1,000 million euros relating to a fixed-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in June 2024;

- 500 million Brazilian reals (equivalent to 93 million euros at December 31st, 2023) relating to a floating-rate bond issued by Enel Distribuição Ceará, maturing in May 2024;

- 650 million Brazilian reals (equivalent to 121 million euros at December 31st, 2023) relating to a floating-rate bond issued by Enel Distribuição Ceará, maturing in June 2024;

- 850 million pounds sterling (equivalent to 981 million euros at December 31st, 2023) relating to a fixed-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in August 2024;

- 250,000 million Colombian pesos (equivalent to 58 million euros at December 31st, 2023) relating to a fixed-rate bond issued by Enel Colombia, maturing in August 2024;

- 225 million Swiss francs (equivalent to 242 million euros at December 31st, 2023) relating to a fixed-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in September 2024;

- 1,500 million US dollars (equivalent to 1,358 million euros at December 31st, 2023) relating to a fixed-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in September 2024;

- 1,250 million euros relating to a fixed-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in September 2024;

- 985 million euros relating to a fixed-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in January 2025;

- 50 million euros relating to a floating-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in April 2025;

- 180 million euros relating to a fixed-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in April 2025;

- 51 million euros relating to a floating-rate bond issued by Enel, maturing in May 2025;

- 700 million Brazilian reals (equivalent to 130 million euros at December 31st, 2023) relating to an amortizing floating-rate bond issued by Enel Distribuição São Paulo, maturing in May 2025;

- 270 million Brazilian reals (equivalent to 50 million euros at December 31st, 2023) relating to an amortizing floating-rate bond issued by Enel Distribuição Ceará, maturing in June 2025;

- 750 million US dollars (equivalent to 679 million euros at December 31st, 2023) relating to a fixed-rate bond issued by Enel Finance International and guaranteed by Enel, maturing in June 2025.

Recent events

November 22nd, 2023: Enel has announced that its subsidiaries Enel Américas SA (“Enel Américas”) and Enel Perú SAC (“Enel Perú”), the latter controlled by Enel through the Chilean listed company Enel Américas, have signed an agreement with Niagara Energy SAC (“Niagara Energy”), a Peruvian company controlled by the global investment fund Actis, for the sale of all the equity stakes held by the Enel Group in power generation companies Enel Generación Perú SAA (“Enel Generación Perú”) and Compañía Energética Veracruz SAC ("Compañía Energética Veracruz"). Specifically, the agreement establishes that Niagara Energy will acquire the stakes held by Enel Perú and Enel Américas in Enel Generación Perú’s share capital (equal to approximately 66.50% and 20.46%, respectively) as well as those held by Enel Perú in Compañía Energética Veracruz’s share capital (equal to 100%) for a total consideration of about 1.4 billion US dollars (approximately 1.3 billion euros[1]), equivalent to an overall enterprise value of around 2.1 billion US dollars (about 1.9 billion euros[2], on a 100% basis). This consideration is subject to adjustments customary for these kinds of transactions in consideration of the time between signing and closing.

December 29th, 2023: Enel announced that, through its 100% subsidiary Enel Green Power S.p.A. (“EGP”), had finalized the sale of 50% of Enel Green Power Hellas (“EGPH”), EGP's fully-owned renewable energy subsidiary in Greece, to Macquarie Asset Management, acting through Macquarie Green Investment Group Renewable Energy Fund 2 (“MGREF2”), following the fulfilment of all the conditions precedent customary for these kinds of transactions, including the clearance from competent Antitrust authorities, set forth in the related sale agreement signed on July 26th, 2023. In line with the above agreement, the total consideration cashed in by EGP was approximately 350 million euros, equal to an enterprise value on a 100% basis of approximately 980 million euros. Following the transaction’s closing, EGP and Macquarie Asset Management entered into a shareholder agreement which envisages the joint control of EGPH in order to co-manage the company's current renewable generation portfolio alongside continuing to develop its project pipeline, further increasing its installed capacity.

January 16th, 2024: Enel announced that Enel Finance International N.V. (“EFI”), a finance company controlled by Enel itself had launched a dual-tranche “Sustainability-Linked bond” for institutional investors in the Eurobond market for a total of 1.75 billion euros. The issue, which is guaranteed by Enel, was more than three times oversubscribed, with total orders of approximately 5.8 billion euros and a significant participation of Socially Responsible Investors (SRI). The new issue envisages the use of two sustainability Key Performance Indicators (“KPIs”) for each tranche, illustrated in the Sustainability-Linked Financing Framework last updated in January 2024, confirming Enel's commitment towards the energy transition as well as contributing to the environmental and financial sustainability of the Company's development strategy.

The issuance is structured in the following two tranches:

- 750 million euros, at a fixed rate of 3.375% maturing July 23rd, 2028;

- 1,000 million euros, at a fixed rate of 3.875% maturing January 23rd, 2035.

The new Sustainability-Linked Bond contributes to the achievement of the Group objectives related to sustainable funding sources on Group’s total gross debt, set at around 70% in 2026.

January 22nd, 2024: Enel announced that it had completed – as a result of the purchase transactions completed on January 18th, 2024 – the treasury shares purchase program to serve the Long-Term Incentive Plan for 2023 for Enel and/or its subsidiaries’ management pursuant to Art. 2359 of the Italian Civil Code, which was launched on October 16th, 2023. As part of this program, Enel purchased a total of 4.2 million treasury shares, equal to approximately 0.0413% of the share capital, at a volume-weighted average price of 6.3145 euros per share and for a total consideration of 26,520,849.002 euros.

February 20th, 2024: Enel announced that it had successfully launched on the European market the issuance of a non-convertible subordinated perpetual hybrid bond for institutional investors denominated in euros, for an aggregated principal amount of 900 million euros. The issuance was more than three times oversubscribed, with total orders for more than 3 billion euros. The non-convertible subordinated perpetual hybrid bond is structured in a single 900-million-euro tranche, has no fixed maturity, and is due and payable only in the event of winding up or liquidation of the Company, as specified in the relevant terms and conditions.

March 1st, 2024: Enel announced that, acting through its subsidiary Enel Italia SpA (“Enel Italia”), it had signed an agreement with Sosteneo Fund 1 HoldCo Sàrl ("Sosteneo HoldCo")[3] for the acquisition by the latter of 49% of the share capital of Enel Libra Flexsys S.r.l. (“Enel Libra Flexsys”), a company fully-owned by Enel Italia and established for the implementation and operation of a portfolio of:

- 23 Battery Energy Storage System (BESS) with a total capacity of 1.7 GW;

- 3 renovation projects for Open Cycle Gas Turbine (OCGT) plants with a total capacity of 0.9 GW.

The agreement foresees the recognition of a consideration by Sosteneo HoldCo of approximately 1.1 billion euros for the acquisition of 49% of the share capital of Enel Libra Flexsys. Furthermore, the consideration is subject to an adjustment mechanism customary for these kinds of transactions. The enterprise value on a 100% basis of Enel Libra Flexsys recognized in the agreement is equal to around 2.5 billion euros, once the investment cycle foreseen by the project will be completed.

The closing of the sale is subject to a number of conditions precedent customary for these kinds of transactions, including the clearance from the competent antitrust authorities and the successful completion of the golden power procedure with the Presidency of Italy’s Council of Ministers.

March 9th, 2024: Enel announced that, with the aim of rationalizing the management of the distribution networks that interoperate in Lombardy, its subsidiary e-distribuzione S.p.A. (“e-distribuzione”) had signed an agreement with A2A S.p.A. (“A2A”) for the sale to the latter of 90% of the capital of a newly incorporated vehicle (“NewCo”), to which electricity distribution activities in some municipalities of the provinces of Milan and Brescia[4] will be contributed. The agreement provides for A2A to pay a consideration of approximately 1.2 billion euros, based on an enterprise value (for 100% of the company) of around 1.35 billion euros. The consideration, which will be paid at closing, is subject to a price adjustment mechanism customary for these kinds of transactions. Upon completion of the transaction, e-distribuzione will retain a 10% stake of NewCo’s capital, to support the startup phase of the company, and which will be subject to a put and call option mechanism, that can be triggered starting from the first year from completion of the transaction. Furthermore, specific agreements between the parties are foreseen through which e-distribuzione will guarantee supporting activities to ensure continuity of the service. The closing of the transaction is subject to a number of conditions precedent, including Antitrust clearance, the successful completion of the golden power procedure by the Presidency of Italy’s Council of Ministers and the authorization to transfer the electricity distribution service concessions to NewCo.

More information on these events is available in the related press releases published on the Enel website at https://www.enel.com/en/media/explore/search-press-releases

Notes

At 6:00 p.m. CET today, March 21st, 2024, a conference call will be held to present the results for 2023 and the progress of the 2024-2026 Strategic Plan to financial analysts and to institutional investors. Journalists are also invited to listen in on the call. Documentation relating to the conference call will be available on the Enel website www.enel.com, in the “Investors” section, from the beginning of the conference call. The Consolidated Income Statement, Statement of Consolidated Comprehensive Income, Statement of Consolidated Financial Position and Consolidated Statement of Cash Flows of the Enel Group and the analogous financial statement formats of the Parent Company Enel, are attached hereto. It should be noted that these tables and the explanatory notes have been submitted to the Board of Statutory Auditors and to the external auditors for their assessments. A descriptive summary of the "alternative performance indicators" used in this press release is also attached. The officer responsible for the preparation of the corporate financial reports, Stefano De Angelis, certifies in accordance with Art. 154-bis, paragraph 2, of the Consolidated Financial Act that the accounting information contained in this press release corresponds with that contained in the accounting documentation, books and records.

Accounting standards, data comparability and amendments to the scope of consolidation

The balance sheet data at December 31st, 2023 exclude (unless otherwise indicated) the values relating to assets and liabilities held for sale attributable to the activities, in Peru, of electricity distribution and generation as well as to advanced energy services, to 3SUN in Italy, to the activities related to a portfolio of renewable assets in the United States, to a wind farm under construction in Colombia, to Ngonye in Africa, to Compañía de Transmisión del Mercosur S.A. and Transportadora de Energía S.A. in Argentina and to Finsec Lab in Israel. The data reported and commented on above are therefore homogeneous and comparable in the two periods under comparison.

Regarding data reporting by Business Segment, the following adjustments were made:

- the figures for Enel X, that in the year ending on December 31st, 2022 were reported separately, were included under End-User Markets;

- the figures for Enel X Way that in the year ending on December 31st, 2022 were reported under “Holding, Services and Other”, were included under End-User Markets.

In order to improve the reporting of net financial debt, the Group has decided to exclude from its determination the fair value of the cash flow hedge and fair value hedge derivatives used to hedge the exchange rate risk on loans. Accordingly, in order to improve the comparability of figures, it was necessary to recalculate the net financial debt at December 31st, 2022 for an amount equal to 595 million euros.

The Consolidated Balance Sheet for the 2022 Consolidated Financial Statements has been restated to take into account the effects of the Amendment to IAS 12, in force after January 1st, 2023, which clarifies that the exemption from initial recognition provided for by the standard no longer applies to transactions that give rise to taxable and deductible temporary differences of the same amount on transactions such as leasing and decommissioning.

The Consolidated income statement and Total consolidated income statement relating to the 2022 Consolidated Financial Statements, have been adjusted to take into account the submission of the results attributable to a number of operational activities discontinued during the fourth quarter of 2023 in line with the provisions of “IFRS 5 – Non-current assets held for sale and discontinued operations”.

Key performance indicators

This press release uses some “alternative performance indicators” that are not envisaged by the international accounting standards adopted by the European Union – IFRS-EU, but which management deems useful for the better evaluation and monitoring of the Group's economic and financial performance. With regard to these indicators, on April 29th, 2021, CONSOB issued Warning Notice no. 5/21 making applicable the Guidelines issued on March 4th, 2021 by the European Securities and Markets Authority (ESMA) on disclosure requirements pursuant to EU Regulation 2017/1129 (the so-called “Prospectus Regulation”), which are applicable from May 5th, 2021 and replace the references to the CESR recommendations and those in Communication no. DEM/6064293 of July 28th, 2006 on net financial position.

The Guidelines update the previous CESR Recommendations (ESMA/2013/319, as revised on March 20th, 2013) with the exception of those concerning issuers carrying out special activities set out in Annex no. 29 of Delegated Regulation (EU) 2019/980, which have not been converted into Guidelines and still remain applicable.

These Guidelines are intended to promote the usefulness and transparency of alternative performance indicators included in regulated information or prospectuses within the scope of application of Directive 2003/71/EC, in order to improve their comparability, reliability and comprehensibility.

In line with the abovementioned communications, the criteria used for the construction of these indicators for the Enel Group are provided below:

- EBITDA is an indicator of Enel’s operating performance, calculated as “EBIT” plus “Impairment losses / (Reversals of impairment) net of trade and other receivables” and “Depreciation, amortization and impairment losses”;

- Ordinary EBITDA is defined as the "EBITDA" attributable to ordinary operations only, linked to the business models of Ownership, Partnership and Stewardship according to which the Group operates, integrated with the ordinary EBITDA attributable to discontinued operations, if present. It also excludes costs associated with corporate restructuring plans and “extraordinary solidarity contributions” established by local governments abroad to be paid by companies in the energy sector;

- Group net ordinary income is determined by rectifying “Group net income” from the items previously commented on in “Ordinary EBITDA”, taking into account any tax effects and non-controlling interests. Furthermore, it excludes certain financial components not strictly attributable to the Group's core operations, as well as the extraordinary solidarity contribution to be paid by companies in the energy sector in Italy;

- Net financial debt is an indicator of the financial structure, determined by:

- “Long-term borrowings”, “Short-term borrowings”, “Current portion of long-term borrowings”, “Other non-current financial liabilities” and the “Other current financial liabilities included in net financial debt” entry included in “Other current financial liabilities”;

- net of “Cash and cash equivalents”;

- net of “Current financial assets included in net financial debt”, included in "Other current financial assets", which includes: (i) the current portion of long-term financial receivables; (ii) securities; (iii) financial receivables; (iv) other current financial assets;

- net of “Other non-current financial assets included in net financial debt” included in "Other non-current financial assets" which includes: (i) securities; (ii) financial receivables.

More generally, the Enel Group's net financial debt is reported in accordance with the provisions of Guideline no. 39, issued on March 4th, 2021 by ESMA, applicable as from May 5th, 2021, and with the above Warning Notice no. 5/21 issued by CONSOB on April 29th, 2021.

- Net capital employed is calculated as the algebraic sum of “Net non-current assets”[5] and “Net current assets”[6], “Provisions for risks and charges”, “Employee benefits”, “Deferred tax liabilities”, “Deferred tax assets”, and “Net assets held for sale”.